What is the Margin of safety? Importance, Calculations, Benefits

Contents

A break-even analysis may also be a useful tool for determining precise sales goals for your team. When you have a precise quantity and a timeframe in mind, it’s typically easier to decide on revenue goals. Fixed costs are those that do not change regardless of how much of a product or service is sold. Fixed costs include facility rent or mortgage, equipment expenditures, salaries, capital interest, property taxes, and insurance premiums, to name a few.

Is the point at which a product’s production costs equal its sales revenue. In essence, a product’s sales and production expenses are “even.” You will learn the production level you must maintain to remain profitable from this.

Introduction to Break-Even Analysis

It helps in the measurement of profit and losses at different levels of production and sales. Break-even point shows the level of production where a business will run at “no profit, no loss”. It is very important for all businesses to achieve a break-even point for any project.

Sales values at various levels of output are plotted joined and the resultant line is the sales line. The contribution margin reveals how a lot of the company’s revenues shall be contributing towards masking the fixed costs. It can be expressed on per unit foundation or for the entire quantity. It’s one of the largest questions you have to reply if you’re beginning a business.

The break-even point method is calculated by dividing the total fixed prices of production by the worth per unit less the variable costs to supply the product. Let’s take a look at a number of of them as well as an example of how to calculate break-even level. It can easily be calculated by subtracting the margin of safety from actual sales.

Break-even analysis can help you reduce risk by eliminating unprofitable projects or business units. The assumption behind break-even analysis is that all costs and spending can be clearly divided into fixed and variable components. In reality, however, a clear distinction between fixed and variable expenses may be difficult to make. The information, product and services provided on this website are provided on an “as is” and “as available” basis without any warranty or representation, express or implied.

Once these numbers are decided, it’s fairly simple to calculate break-even point in items or gross sales value. The point at which total revenue and total cost are equal is known as the break-even point. Break-even analysis calculates the number of units or revenue required to cover your company’s entire costs. You are neither losing or gaining money at the break-even point, but all of your business’s expenses will have been paid.

Module 6. Working capital management

The unit needs to sell 3334 pens in a month to achieve break-even. However a break-even analysis can tell you when you’ll break even, it can’t tell you how probable it is to happen. Furthermore, demand is volatile, so even if you believe there is a huge untapped https://1investing.in/ market, your break-even threshold may be much higher than you anticipated. Entrepreneurs that are successful make judgments based on facts. When you’ve put in the effort and have meaningful data in front of you, making a decision will be much easier.

Is significant, the company is likely in good financial shape, and its cash flows are more stable. For the latest updates, news blogs, and articles related to micro, small and medium businesses , business tips, income tax, GST, salary, and accounting. This formula shows the total number of sales above the breakeven point.

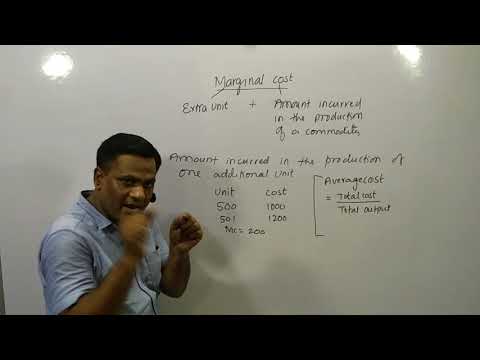

The average variable cost is obtained by dividing the total variable cost by the quantity produced. The average cost is calculated by dividing the total cost by the number of units produced. Further, while discussing, the term marginal costing and break even analysis may appear frequently. Marginal cost is the extra cost incurred in producing one extra unit of a good. This can help determine how variable costs can affect the volume of production in a business unit.

Break-even analysis is an essential economic tool that helps to determine the point beyond which a company earns a profit. It helps businesses calculate the volume of products that need to be sold so that a company overcomes all the initial cost of investment. Reaching this break-even point means that a company is no more in a state of loss. If you already have a enterprise, you need to nonetheless do a break-even analysis before committing to a new product—particularly if that product goes to add significant expense. Even in case your fastened costs, like an office lease, keep the same, you’ll have to work out the variable prices related to your new product and set prices before you start selling. This margin calculator will be your greatest pal if you wish to find out an merchandise’s income, assuming you realize its value and your required profit margin share.

- Variable costs include packaging cost, cost of raw material, fuel, and other materials related to production.

- To put it another way, it’s a financial formula that determines how many things or services a business should sell or offer to pay its costs .

- However a break-even analysis can tell you when you’ll break even, it can’t tell you how probable it is to happen.

- For example, if earlier an organization needed to sell 50 units of this product to reach breakeven, it will be attained at only 45 units if the selling price is increased.

- Personal expectations and monetary situation of the business should also be taken into consideration.

Khatabook Blogs are meant purely for educational discussion of financial products and services. Khatabook does not make a guarantee that the service will meet your requirements, or that it will be uninterrupted, timely and secure, and that errors, if any, will be corrected. The material and information contained herein is for general information purposes only. Consult a professional before relying on the information to make any legal, financial or business decisions. Khatabook will not be liable for any false, inaccurate or incomplete information present on the website.

Break-Even Analysis

Sensitivity analysis is a tool used for financial modelling by analyzing different values of independent variables affecting a specific dependent variable under specific conditions. It is used for analysis under various disciplines like Biology, Economics, Maths, etc. There are more than a few ways to calculate your break-even point. To fully understand break-even formulas, it is important to know that different types of costs exist.

These costs come into existence once the financial activity of a business starts. The fixed costs include taxes, salaries, rents, depreciation cost, labor cost, interests, energy cost, etc. Fixed and variable costs may have an impact on an organization’s profit margin.

Some costs appear as semi-variable, which requires specific expertise for the proper identification. Similarly, in the field of investments, when the market price of an asset is equal to the original cost of acquisition, break-even is said to be achieved. People familiar with investments or follow business news will recall media reports on new companies or startups mentioning break-even.

Business Loan Types

The breakeven point, to put it another way, is the point at which a product’s total revenues equal its total costs. Therefore, with the given variable costs, fixed costs, and selling price of the pen, the company would need to sell 10,000 units of pens to break-even. Break-even analysis helps a company in determining the number of units that needs to be sold in order to cover the cost. Variable cost and selling price of an individual product along with the total cost, are required to evaluate the break-even analysis.

New entries to the market may have an impact on demand for your items or force you to adjust your prices, affecting your break-even point. It is proven to be inappropriate in sectors such as shipbuilding. If fixed expenditures are not taken into account while valuing work in progress, losses may occur each year until the contract is finished.

The quantity of capital used in the firm is not taken into account in the break-even analysis. In reality, the amount of capital utilized is a key factor in determining a company’s profitability. A break-even analysis is a financial method for evaluating when a business, a new service, or a product will become profitable. Indicates that you don’t have much leeway in sales and that you should concentrate on decreasing costs if sales decline. At a lower margin of Safety, the organisation will need to make changes by cutting down some of its expenses.

Components of break-even analysis

A little more technically, in accounting terms, it indicates the production level at which the total production income is equal to the total production cost. It is assumed that variable costs are proportional to output volume. They move in correlation with production volume in practice, although not always advantages and disadvantages of break even analysis in exact proportions. Assuming that the selling price remains constant results in a straight revenue line, which may or may not be accurate. The selling price of a product is determined by a variety of factors such as market demand and supply, competition, and so on, and it seldom remains constant.

Therefore, a company already has an exact figure about the number of units to be sold to overcome losses. Revenue is the money that a business truly receives from its prospects for the provisions of products and providers during a selected interval. Discounts and deductions have already been adjusted, which means it’s the gross revenue from which varied costs are later deducted to be able to calculate revenue or loss. Total income may be calculated by multiplying the worth at which items or services are offered by number items offered. The timeframe will be dependent on the period you utilize to calculate mounted prices . For this, you’ll need to depend on good cash flow administration, and presumably a solid gross sales forecast .